Physical Address

4 Elgon Terrace, Kololo, Kampala, Uganda

Physical Address

4 Elgon Terrace, Kololo, Kampala, Uganda

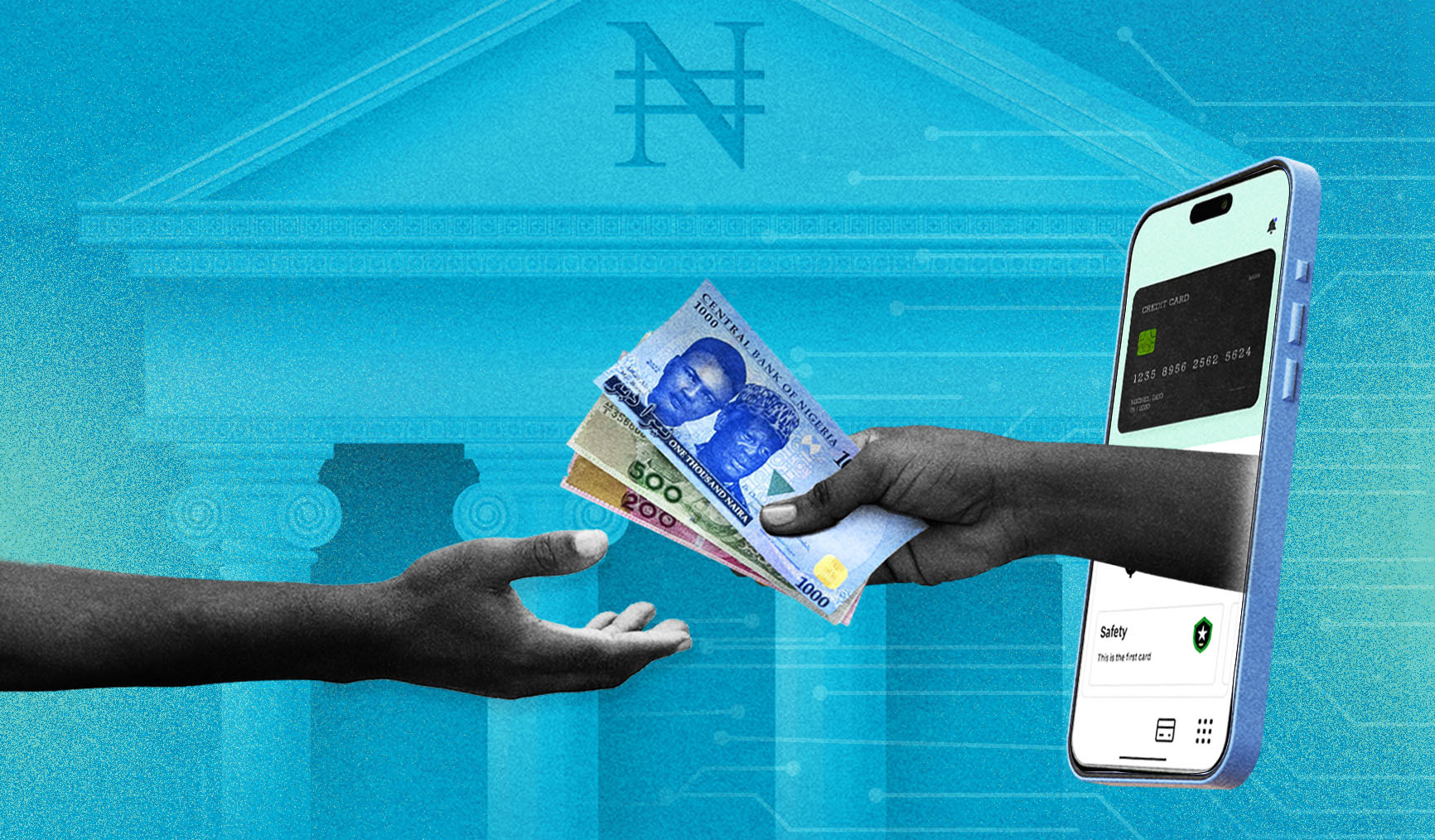

As digital lending apps continue to proliferate in Nigeria, government regulators have moved swiftly to introduce reforms aimed at protecting consumers from exploitative practices. In July 2025, the Federal Competition and Consumer Protection Commission (FCCPC) gazetted the Digital, Electronic, Online, or Non-Traditional Consumer Lending Regulations (DEON), 2025, marking one of the most significant regulatory efforts in the country’s digital finance sector.

The Regulations require all digital lenders operating in Nigeria—whether via smartphone apps, mobile money platforms, or online portals—to register with the FCCPC within 90 days. Lenders who fail to comply may incur penalties of up to ₦100 million or 1% of their turnover. Directors of non-compliant firms could also face disqualification for up to five years.

Other key provisions include bans on unsolicited marketing, automatic/pre-authorised lending, and abusive debt recovery methods. Transparency is emphasized: lenders must clearly disclose all fees, interest rates, tenor, and repayment terms. Data privacy standards and responsible lending practices are also core parts of the regulation.

With over 460 digital lenders currently operating, many Nigerians have raised concerns about predatory interest rates, hidden fees, constant harassment over loan repayment, and data misuse. Several studies and consumer reports describe these issues as systemic in the digital credit sector. As usage of these apps surges, protecting consumer rights is becoming essential to maintain trust and stability.

Some risks lie ahead: stricter compliance and licensing requirements may raise costs for smaller providers, potentially limiting access. Borrowers may face higher interest or service costs passed on due to the burden of meeting regulatory requirements. Also, enforcement will will matter: how well the FCCPC can monitor, sanction, and ensure lenders follow these rules.

The digital lending boom in Nigeria is pushing regulatory reform — and it’s about time. The new DEON Regulations, 2025 bring clarity, protection, and accountability to an industry long criticized for unfairness. If well-implemented, these rules could balance innovation with respect for consumer rights, and ensure the sector grows sustainably.